Embarking on the entrepreneurial journey is akin to navigating uncharted waters. While the allure of independence and potential success is strong, the initial phase can often be riddled with financial uncertainties. A strategic approach to managing your initial resources is indispensable to steering your business toward stability and growth. From Welvis Marketing, this guide offers a roadmap to help you navigate these challenges, focusing on practical strategies to establish a firm financial footing in the early stages of your business journey.

Strategic Goal Setting: Laying the Foundation

Your entrepreneurial journey begins with a clear vision of what you want to achieve. You must delineate your aspirations, distinguishing between immediate objectives and long-term ambitions. This clarity acts as your compass, guiding your decisions and resource allocation. By setting measurable and attainable goals, you create a framework that not only guides your business trajectory but also serves as a benchmark for progress. This foundation is vital for maintaining focus amid the myriad challenges and opportunities that you will encounter.

Cultivating a Network of Allies: Beyond Connections

In the realm of business, the strength of your network often dictates the height of your success. Forge relationships with individuals who bring diverse perspectives and experience. This network, encompassing mentors, industry colleagues, and potential collaborators, becomes a reservoir of wisdom. The insights and opportunities garnered from these connections can be pivotal in overcoming hurdles and unlocking new avenues for your business. Remember, the objective is not just to build a network but to nurture relationships that add tangible value to your entrepreneurial journey.

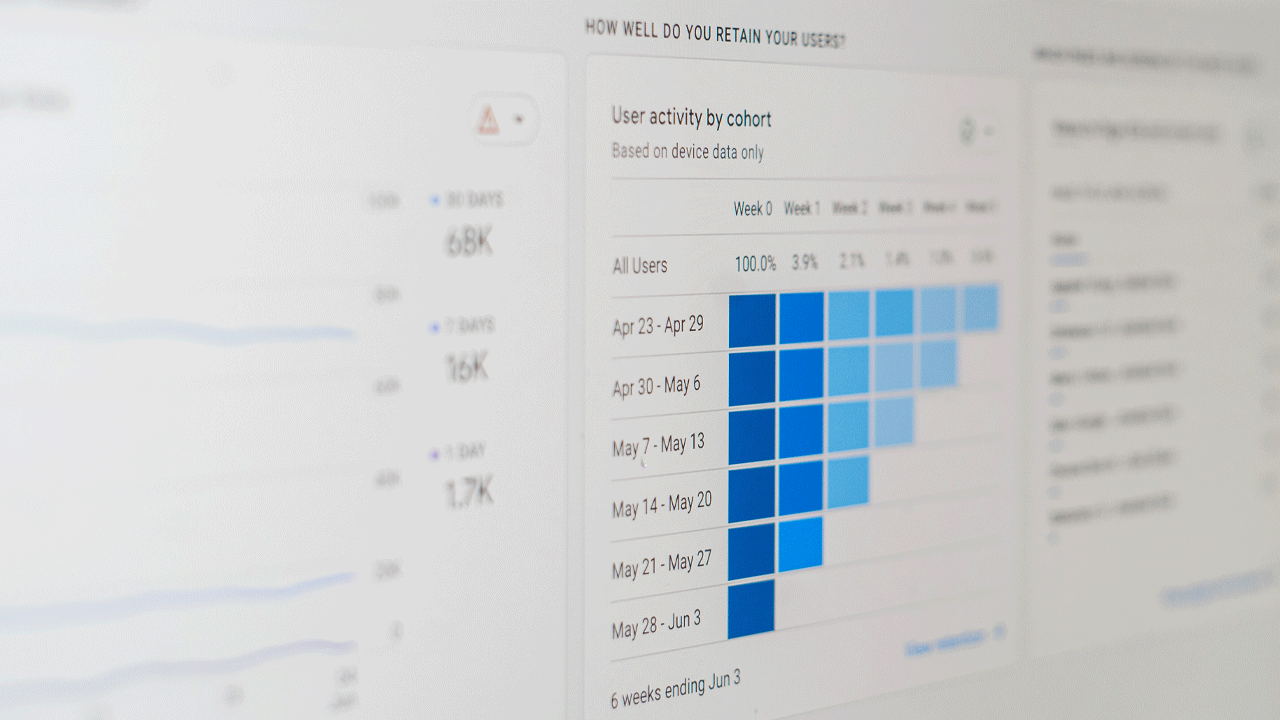

Mastery of Cash Flow: The Lifeline of Your Business

Cash flow is the lifeblood of your business, necessitating meticulous management. This involves a vigilant eye on both income and expenses. Craft a budget that caters to your crucial expenses while leaving room for unforeseen costs. Embracing modern accounting tools can simplify this task, offering you a clear view of your financial health. This vigilance in cash flow management is not just about survival; it’s about creating a stable platform from which your business can grow.

Exploring Capital Infusion: Fueling Growth

There comes a point where external funding becomes necessary to scale your business. This could take the form of investor funding, loans, or even crowdfunding. Each option comes with its own set of implications and requirements. It’s imperative to align your choice of funding with your business’s ethos and objectives. This strategic selection of financial support not only injects needed capital but also opens doors to new networks and opportunities.

Diversifying Revenue Streams: A Safety Net

In the initial phase, relying solely on your business for income can be precarious. It’s prudent to explore additional sources of revenue. This could be freelance work or part-time engagements that align with your skills and schedule. Such endeavors provide a financial cushion, reducing the strain on your business’s cash flow and allowing you the liberty to focus on sustainable growth.

Home Office: A Dual-Edged Sword

Establishing a home office is more than a convenience; it’s a strategic decision. A dedicated workspace enhances productivity and focus. Additionally, it opens up opportunities for tax deductions, directly benefiting your business finances. Documenting expenses related to your home office can contribute to significant savings, as well as justify the increase in value of your home, making it a financially savvy move.

Embracing Bootstrapping: A Path to Autonomy

Bootstrapping is a testament to your resourcefulness and commitment. It involves growing your business through minimal external assistance, relying primarily on internally generated revenue. This approach demands astute financial management and a frugal mindset. However, the benefits are manifold – it fosters a deep understanding of your business, instills a culture of efficiency, and ensures greater control over your venture.

The journey of establishing and nurturing a new business is fraught with challenges, yet it is equally rewarding. By adopting these strategic approaches, you position yourself not just to survive the initial hurdles but to thrive. The emphasis on clear goal setting, building a robust support network, meticulous cash flow management, smart capital infusion, income diversification, strategic home office setup, and embracing bootstrapping collectively create a strong foundation for your business. This foundation is not just about weathering the storm; it’s about setting sail toward a successful and fulfilling entrepreneurial voyage.